Investing in real estate can be a lucrative venture, and among the various options available, Luxury Real Estate Investment Trusts (Luxury REITs) have garnered significant attention. If you’re considering diversifying your investment portfolio with Luxury REITs, it’s essential to understand both the advantages and potential drawbacks. This comprehensive guide will walk you through everything you need to know, empowering you to make informed decisions that align with your financial goals.

Understanding Luxury REITs

Before diving into the pros and cons, it’s crucial to grasp what “Investing in Luxury REITs” entails. A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate. Luxury REITs specifically focus on high-end properties, such as upscale apartment buildings, premium office spaces, luxury hotels, and exclusive retail centers. Investing in Luxury REITs provides a unique opportunity to enter the luxury real estate market without the need to directly own or manage properties.

For a more in-depth explanation of how REITs work, visit Investopedia’s guide on REITs.

By investing in Luxury REITs, you gain exposure to the luxury real estate market without needing to purchase properties directly. This approach offers a blend of real estate stability and the potential for attractive returns, making investing in luxury REITs an appealing option for many investors.

To get a foundational understanding of real estate business strategies, check out Real Estate Business Planning Guide: Your Blueprint for Success.

Pros of Investing in Luxury REIT

Investing in Luxury REITs comes with a host of benefits that can enhance your investment portfolio. Here’s a detailed look at the primary advantages:

1. High-Quality Assets

Luxury REITs typically invest in premium properties located in desirable areas. These high-quality assets tend to maintain their value better during economic downturns and can attract reliable tenants willing to pay premium rents. By investing in Luxury REITs, you benefit from the inherent quality of these properties, often resulting in lower vacancy rates and consistent income streams.

2. Potential for Strong Returns

Luxury properties generally command higher rents and can appreciate significantly over time. This potential for capital appreciation, combined with regular dividend payouts from rental income, can result in robust returns for investors. Additionally, the exclusivity of luxury properties can insulate them from some market fluctuations, enhancing their long-term investment appeal.

3. Diversification

Including Luxury REITs in your investment portfolio introduces diversification, reducing overall risk. Real estate often behaves differently than stocks and bonds, providing a hedge against market volatility. Moreover, luxury properties span various sectors, including residential, commercial, and hospitality, further spreading your investment risk.

4. Passive Income

Luxury REITs offer a way to earn passive income without the hassles of property management. As an investor, you receive dividends from the REIT’s income-generating properties, allowing you to enjoy regular payouts without the need to manage tenants, maintenance, or other operational aspects.

5. Professional Management

Luxury REITs are managed by experienced professionals who specialize in high-end real estate markets. This expertise ensures that properties are well-maintained, strategically located, and effectively marketed to attract premium tenants. Professional management also means that investment decisions are based on thorough market analysis and industry knowledge.

Cons of Investing in Luxury REITs

While investing in Luxury REITs offers numerous benefits, they also come with certain drawbacks that you should consider before investing. Here are the primary disadvantages:

1. Higher Initial Investment

Luxury REITs often require a higher minimum investment compared to other REITs. This can make them less accessible to novice investors or those with limited capital. Additionally, the premium nature of the properties means that the entry point for investment is generally higher.

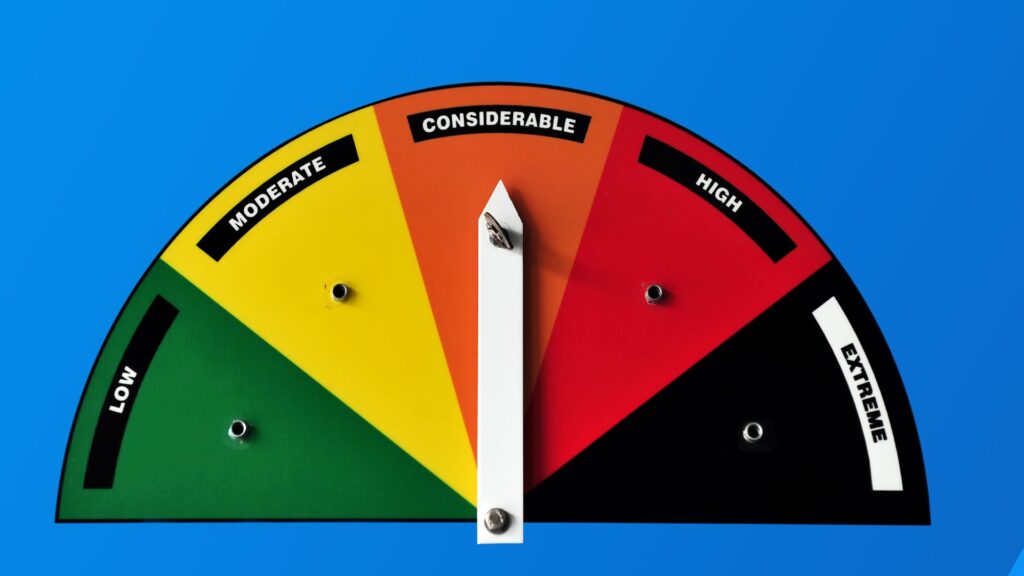

2. Market Volatility

The luxury real estate market can be volatile, and luxury properties are no exception. Market downturns, changes in interest rates, or shifts in consumer preferences can significantly impact the performance of Luxury REITs. This means that investing in Luxury REITs requires a certain level of risk tolerance, especially during times of economic uncertainty.

3. Limited Liquidity

Luxury REITs may have lower liquidity compared to publicly traded REITs. This means that selling your investment can take longer and may not always be possible at your desired price. Limited liquidity can be a challenge if you need to access your funds quickly.

4. Management Fees

Professional management comes at a cost. Luxury REITs typically charge higher management fees to cover the expenses associated with maintaining high-end properties. These fees can eat into your overall returns, reducing the net profit you receive from your investment.

5. Economic Sensitivity

Luxury properties are more sensitive to economic changes. During economic downturns, demand for high-end real estate may decline as individuals and businesses cut back on luxury expenditures. This sensitivity can lead to increased vacancies and lower rental income, impacting the REIT’s profitability.

Key Considerations Before Investi

Before committing to investing in Luxury REITs, it’s essential to evaluate several factors to ensure that this investment aligns with your financial goals and risk tolerance. Here are some things to keep in mind:

Assess Your Financial Goals

Determine what you aim to achieve with your investment. Are you seeking steady income, capital appreciation, or portfolio diversification? Understanding your objectives will help you decide if Luxury REITs are the right fit.

Understand the Market

Research the luxury real estate market trends in the areas where the REIT operates. Factors such as location, economic conditions, and demand for luxury properties can significantly influence the REIT’s performance.

It’s important to know how to mitigate risks and make informed decisions, especially in the luxury market. Take a look at How to Mitigate Risk in Luxury Real Estate Fund Investments for deeper insights into managing risks effectively.

You can refer to CBRE’s market analysis for the latest data on luxury real estate trends and demand factors.

Evaluate the REIT’s Management Team

The success of a Luxury REIT heavily depends on its management team. To better understand what makes an effective REIT management team, refer to this Nareit resource on evaluating REITs. Look into their track record, experience in the luxury real estate sector, and their ability to navigate market challenges effectively.

Consider Fees and Expenses

Be aware of the management fees and other expenses associated with the REIT. High fees can erode your returns, so it’s crucial to understand the cost structure before investing.

Learn more about the cost structure of REITs from Morningstar’s guide on REIT expenses.

Diversify Your Portfolio

While Luxury REITs can be a valuable addition to your portfolio, they should be part of a diversified investment strategy. For beginners, A Beginner’s Guide to Investing in Luxury Real Estate Funds offers an excellent starting point to understand the essentials.

Diversification helps mitigate risks and ensures that your portfolio is not overly reliant on a single asset class.

How to Invest in Luxury REITs

Investing in Luxury REITs involves several steps. Here’s a guide to help you get started:

1. Research and Select a REIT

Start by researching various Luxury REITs available in the market. Look for REITs with a strong portfolio of high-end properties, a proven track record, and experienced management teams. Consider factors like dividend history, occupancy rates, and property locations.

If you’re new to real estate investing, consider reading How to Start a Real Estate Business: Your Step-by-Step Guide for Success in 2025 to build a strong foundation.

2. Open an Investment Account

To invest in REITs, you’ll need a brokerage account. Choose a reputable brokerage firm that offers a user-friendly platform, competitive fees, and robust customer support. Ensure that the platform provides access to the Luxury REITs you’re interested in.

To compare the best brokerage accounts, check out this NerdWallet comparison of brokerage firms.

3. Allocate Your Investment

Decide how much of your portfolio you want to allocate to Luxury REITs. It’s advisable to diversify your investments across different asset classes to balance risk and return. Consider your financial goals, risk tolerance, and investment horizon when determining the allocation.

For insights into strategies that can maximize your returns, check out Top 5 Strategies to Maximize Returns in Luxury Real Estate Funds 2025.

4. Purchase REIT Shares

Once you’ve selected a Luxury REIT and determined your investment amount, you can purchase shares through your brokerage account. Monitor your investment regularly to stay informed about the REIT’s performance and any market developments.

5. Reinvest Dividends

Many Luxury REITs offer dividend reinvestment plans (DRIPs), allowing you to automatically reinvest your dividends to purchase additional shares. This strategy can help compound your returns over time.

FAQs About Luxury REITs

1. What makes a REIT “luxury”?

A Luxury REIT focuses on high-end properties that offer premium amenities and are located in desirable areas. These properties cater to affluent tenants and often include upscale residential units, premium office spaces, luxury hotels, and exclusive retail centers.

2. Are Luxury REITs riskier than other REITs?

Luxury REITs can be riskier due to their sensitivity to economic fluctuations and higher initial investment requirements. However, they also offer the potential for higher returns. Assessing your risk tolerance is crucial before investing.

3. How do Luxury REITs generate income?

Luxury REITs generate income primarily through rental payments from tenants occupying their high-end properties. This income is then distributed to investors in the form of dividends.

4. Can I invest in Luxury REITs through retirement accounts?

Yes, you can invest in Luxury REITs through various retirement accounts, such as IRAs or 401(k)s, depending on the investment options offered by your retirement plan.

5. What are the tax implications of investing in Luxury REITs?

Dividends from REITs are typically taxed as ordinary income. It’s essential to consult with a tax advisor to understand how Luxury REITs fit into your overall tax strategy.

Conclusion and Next Steps

Investing in Luxury REITs offers a unique opportunity to tap into the high-end real estate market without the need to directly manage properties. The potential for strong returns, diversification, and passive income make Luxury REITs an attractive option for many investors. However, it’s essential to weigh these benefits against the associated risks, such as higher initial investments and market volatility.

Before diving into Luxury REITs, conduct thorough research, assess your financial goals, and consider consulting with a financial advisor to ensure that this investment aligns with your overall strategy. By making informed decisions, you can leverage the advantages of Luxury REITs to enhance your investment portfolio and achieve your financial aspirations.

Ready to explore Luxury REITs further? Start by researching reputable Luxury REITs, consult with financial experts, and consider how this investment can fit into your broader financial plan. Taking the first step today could pave the way for substantial financial growth and stability in the future.

Comments 1